Bitcoin

It was July 2020 when I first read about Bitcoin. I found the whole concept of a decentralized digital currency super-interesting. Over the next 1-2 months, I spent time studying it and eventually started buying. Last week Bitcoin reached an all time high. However I think this is not the end, we are going much higher. Let me explain why

Why Bitcoin has value?

To put it in one line I would say— Bitcoin is the most efficient way to transfer value across space-time.

I. The most efficient way

The core idea that Bitcoin questions is “What is money?”— Money in itself does not have value. It’s just a social construct. Since we all believe in the idea of money, money works.

What makes something a good form of money?— For any thing to be accepted as money, it needs to fulfill following six properties— 1. Durability, 2. Portability, 3. Divisibility, 4. Uniformity, 5. Scarcity and 6. Acceptability. Currently cash and gold are the most accepted form of money; Here’s how Bitcoin compares to them on the basis of the above properties

This makes Bitcoin the most advanced form of money; for the first time, we have something that fulfills all the six properties; and regarding acceptability, it’s just a function of time. Bitcoin is making progress with each day passing.

II. Transferring value across space

Today everything is going global and digital. Yet it still takes around 2-3 business days to transfer money from one bank account to another + involves a lot of fees due to a number of intermediaries involved in the process.

Moreover if you want to transact internationally, it takes more than a week to settle and is super expensive. For context, in 2023, the global remittance flow was around ~$860B. A whole industry is built on this.

Bitcoin allows anybody, anywhere in the world with just a smartphone and an internet connection to send and receive value instantly and at low/ no cost without depending on any third party. This is a profound idea.

This also makes a lot of sense because with the rise of internet since the early 90s, we have been building a whole new economy on the internet. Amazon shifted physical retail to online, Facebook did this with social interaction and so on.

Since every economy has a currency, we need a native currency for the internet economy as well. And just like the internet is not owned by any particular company or a nation, the currency also needs to fulfill the same condition. This is where Bitcoin comes in.

III. Transfering value across time

Ideally, the best way to transfer value across time is to buy something scarce. Historically it has been gold or real estate. That’s how people have preserved their wealth and passed on to generations.

One of the core tenet that makes Bitcoin so valuable is its scarcity. There will only be 21 million bitcoins. This is hard coded into its algorithm and can’t be changed due to its decentralized nature. Now since Bitcoin is also digital, it makes Bitcoin a better store of value than gold or real estate.

For eg: Gold isn’t portable. If you have a lot of wealth in gold, you can’t just carry it with you everywhere. Similarly, with real estate, it creates local dependency due to its immobile nature. It is also prone to wars and conflicts. What if a war breaks out, the value of your real estate goes to zero. Bitcoin on the other hand has all the properties of gold + it is also portable and digital, making it the best way to transfer value across time.

And ofcourse, you can’t hoard cash. The fiat money that we use today, isn’t backed by anything. Government can simply print money out of thin air. Literally. When government prints money, the circulation of money in the economy increases which leads to inflation. Hence it’s not a surprise that the earliest adopters of Bitcoin are those countries that are going through hyperinflation. Bitcoin is the ultimate separation of the money from the State.

If you believe that Dollar or INR or any currency for that matter will continue to lose value going forward (which they will), then Bitcoin has to go up— It’s that simple.

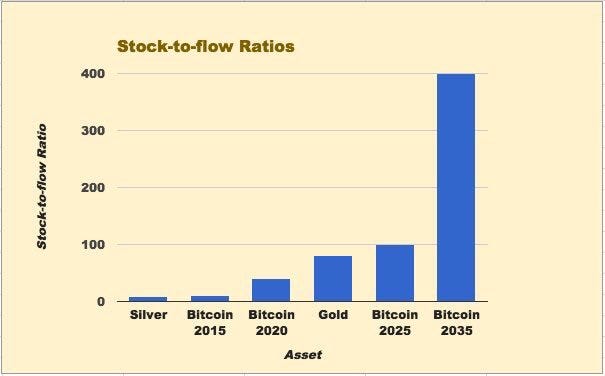

This is why gold today has $14T in market cap. People prefer gold over cash, as it’s a better store of value. What makes a great store of value is usually measured using a stock-to-flow model. It is a method used to quantify the scarcity of a commodity, primarily used for assessing value of precious metals like gold, silver and now Bitcoin as well. The way you calculate is you take the existing stock (total amount available) and divide it by the flow i.e., annual production of that commodity. Here’s how Bitcoin’s S2F compares with gold

This simply means that Bitcoin will soon become a better store of value than gold. And as time goes by, this difference will only increase, since gold’s S2F mostly remains stagnant.

Also, if tomorrow let’s say the demand for gold increases, we can all just mine more gold thereby increasing the supply, whereas in case of Bitcoin the daily supply is fixed. The network adjusts itself if more miners start mining Bitcoin. There is this quote from Jack Mallers that I absolutely love, he says, “Gold is stuck in ground, Bitcoin is stuck in time.” If you want to mine more Bitcoin, you need to time travel into the future, there’s no other option.

The Economics of Bitcoin

The most important law of economics is the law of supply and demand. This is what creates markets. For price to go up, demand has to outpace supply. Now let’s see how this equation applies to where Bitcoin is right now.

I. The supply side

There are two things happening here— 1. As mentioned earlier, the supply of Bitcoin is fixed at 21 million. Moreover, it’s supply i.e, newly mined bitcoins, gets cut in half every 4 years.

There has already been 3 halving events since the inception of Bitcoin in 2011. The next halving is suppose to take place in this year on April 17th. After each halving, the price of Bitcoin has rallied (seen below), which makes sense since the supply is getting reduced.

Secondly, the long-term holders of Bitcoin aren’t selling (as seen below). In fact, in the last few days, the daily no. of bitcoins purchased is 3.5x the number of newly minted bitcoins. So we can conclude that the supply of Bitcoin is growing very slowly (moreover, it’s predictable) and with each halving event it only gets even more slow. Now let’s look at the demand side.

II. The demand side

Why will people/ companies/ countries buy Bitcoin?— To answer this question, we need to look Bitcoin through the lens of Game theory. It’s a field of applied mathematics which seeks to understand how individuals/ entities make choices when their outcomes depend not only on their own decisions but also on the decisions of others.

When a country decides to adopt Bitcoin, all its adversary countries will have to make a decision, whether to adopt Bitcoin or not. Here’s a quote from a recent report by Fidelity—“We also think there is very high stakes game theory at play here, whereby if bitcoin adoption increases, the countries that secure some bitcoin today will be better off competitively than their peers. Therefore, even if other countries do not believe in the investment thesis or adoption of bitcoin, they will be forced to acquire some as a form of insurance.”

In fact, El Salvador has already made Bitcoin as legal tender. Their whole economy runs on Bitcoin. A lot of countries have dropped the plan to outright ban Bitcoin. Almost all of them are moving towards regulating it.

A similar situation will play out at every level— Corporations, fund managers, individuals, everywhere. For Eg: If a fund manager allocates 5% of his portfolio to Bitcoin and the fund outperforms by let’s say 2%, the other fund managers will have no choice but to allocate at least some portion of the portfolio to Bitcoin. Because the funds LPs will definitely question the manager why he hadn’t done this already.

In fact, at the beginning of this year SEC approved around 11 Bitcoin ETFs. These are big players involved— Blackrock, Fidelity, Invesco etc. Blackrock itself manages around $10T of AUM (Assets Under Management). If they decide to allocate just 1% of that to Bitcoin, that’s $100B right there. What if that number shifts to 5%, that’s $500B of inflow. In span of just a over month, Blackrock’s Bitcoin ETF has already crossed $10B of AUM— the fastest growing ETF in history. And this is only the beginning, more funds are yet to come.

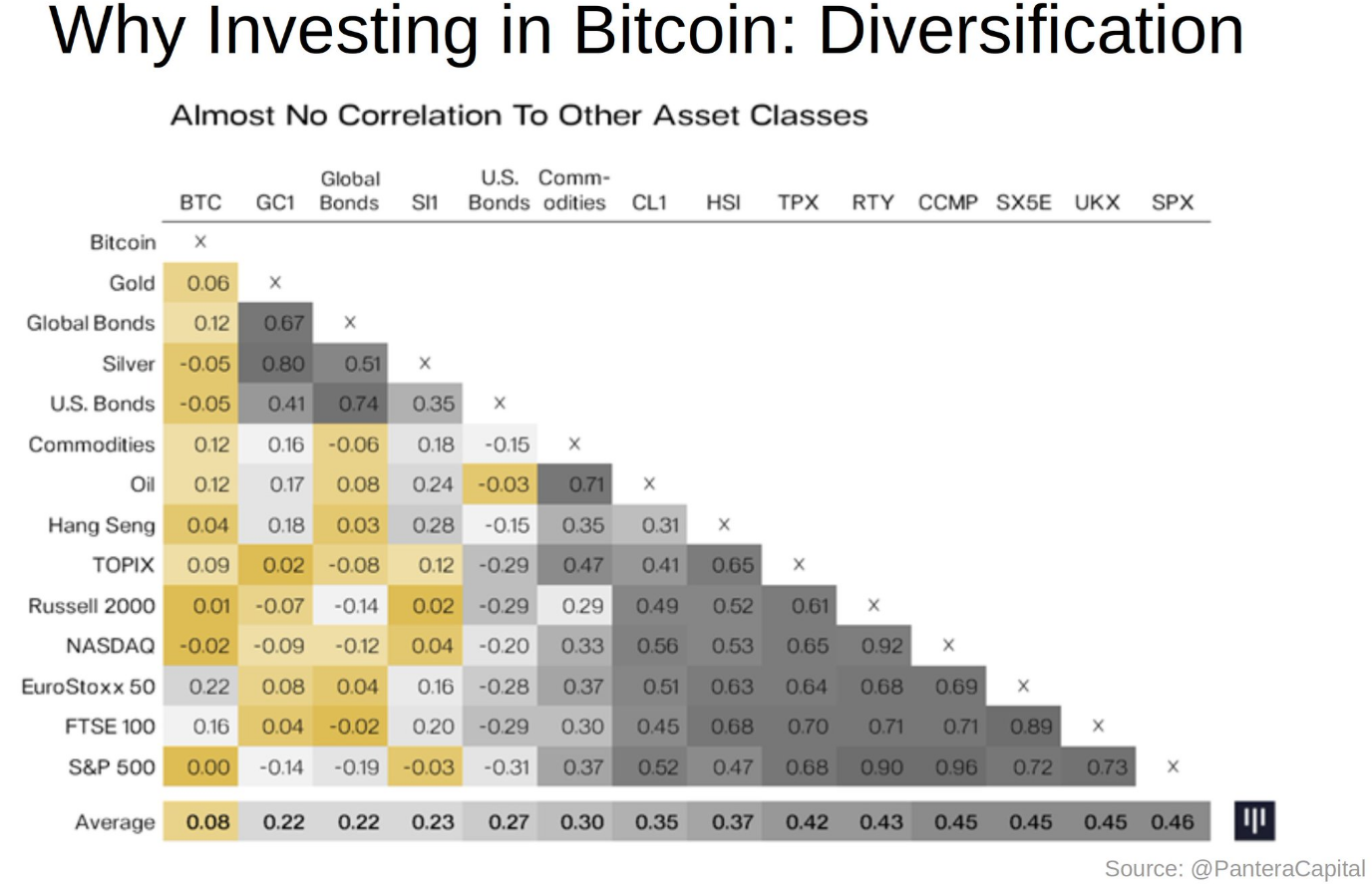

Another reason why investing firms will allocate a portion of their AUM to Bitcoin is because Bitcoin is totally uncorrelated with other major assets. As evident from the picture below. So not only does Bitcoin provide potential for superior returns, it is also a great way to diversify the portfolio.

Additionally, the SEC has already announced three rate cuts this year. And even India will follow the same. When interest rates get cut, bond yield plummets, making stocks and crypto more appealing. This will make even more money to flow into Bitcoin.

The Potential of Bitcoin

Bitcoin’s market cap. = $1.3T

Total AUM of all the investment firms today = $112T; If they were to allocate even 5% to Bitcoin, that’s an additional market cap of $5.6T

Total cash on the balance sheet of companies today = $30T; If they allocate let’s say 5% to Bitcoin; that’s another $1.5T

Cash held by all the central banks in the world today = $44T; 5% of that is another $2.2T

This gives Bitcoin, a market cap of roughly ~$10T ; 7.5x from today’s price. Also do note 1. These numbers are in today’s figure, they are constantly growing; 2. This doesn’t even include retail money yet; Imagine what happens when the retail investors come in

Another way to model Bitcoin is by looking at gold—Gold’s market cap = $14T; since Bitcoin has all the properties of gold + it is digital, making it a 10x improvement on gold; it is fair to assume it can achieve 2x market cap of gold; This leads to an upside of 14Tx2/1.3T = 21T, a 20x from today’s price; Even just by achieving gold’s market cap. it can become 10x from today’s price

Yet another way to look at Bitcoin is through its potential to become the world’s reserve currency. The current geopolitical landscape is very volatile. The US dollar is declining, not that stable as it use to be. Whereas China is gaining power. In the end, no country would want the other country’s currency, especially their enemies’ currency to be the world’s reserve currency. Since Bitcoin isn’t associated to any nation, there is a real possibility (although very speculative), it ends up ascending that throne.

In the next few years we will see a lot of people/ entities piling into Bitcoin. Nothing is more powerful than an idea whose time has come. To quote Bhagavad Gita, “There is no escape from action”. Either you decide to buy Bitcoin, or you decide not to buy Bitcoin. Both of these decisions are actions. And the decision to not to buy Bitcoin is just as powerful as the decision to buy Bitcoin; you are taking the view that there will be less demand for Bitcoin in the future, or that other players will also decide not to buy Bitcoin. But if you are an investor allocating capital, you have to make a decision. No one gets to sit on the sidelines.

Of course, a lot of this may sound speculative, may sound unreal. And I totally agree. But in an uncertain world, all decisions should be based on probabilities. Given the current scenario where rate cuts are expected, institutions coming in to buy and the supply getting cut in half, I would much rather bet Bitcoin goes a lot higher.